The Southern African Development Community (SADC) held its 41st Ordinary Summit of the Heads of State and Government on the 18th August 2021, in Lilongwe, Malawi. The Summit was held under the theme Bolstering Productive Capacities in the Face of COVID 19 Pandemic for Inclusive, Sustainable Economic and Industrial Transformation because the region was dealing with the recovery from the pandemic and facing some divergence. The regional economic recovery from COVID-19 has been disrupted by the outbreak of the Russia-Ukraine conflict and global supply chain disruptions in the aftermath of the pandemic. Nonetheless, current conditions require more concerted investment and determination to pursue regional integration.

As the region prepares for the 42nd Ordinary Summary to be held in Kinshasa, Democratic Republic of Congo (DRC), the region is facing a new challenge – continuing with economic recovery from the pandemic in the context of worsening global uncertainty. One of the most critical issues facing the region includes resolving the energy constraints in the context of contentions and uncertainty about the future of climate financing for renewable energy investment. This is the primary constraint that will affect the regional industrialisation ambitions. The region also needs to support household livelihoods that are being severely affected by rising inflation and higher food and fuel prices. At the same time, the region needs to mitigate the impact of climate change on food security and food production in the region whilst also investing in climate resilience. This means that the SADC region agenda on macroeconomic convergence remains crucially important to strengthen the regional resilience and deepen regional integration throughout Southern Africa.

Regional Integration Monitor Dashboard

| Position | Countries | Summit Chairperson |

| Outgoing Chair | Mozambique | H.E. Filipe Jacinto Nyusi |

| Current Chair | Malawi | H.E Dr. Lazarus McCarthy Chakwera |

| Incoming Chair | DRC | H.E. Félix Antoine Tshisekedi Tshilombo |

| Attendance | 40th Summit Held Virtually* | 41st Summit in Malawi | 42nd Summit in the DRC |

| Angola | Y | R | Aug 2022 |

| Botswana | Y | Y | Aug 2022 |

| Comoros | R | R | Aug 2022 |

| DRC | Y | Y | Aug 2022 |

| Eswatini | R | R | Aug 2022 |

| Lesotho | Y | R | Aug 2022 |

| Madagascar | Y | Y | Aug 2022 |

| Malawi | Y | Y | Aug 2022 |

| Mauritius | R | R | Aug 2022 |

| Mozambique | Y | Y | Aug 2022 |

| Namibia | Y | R | Aug 2022 |

| Seychelles | R | R | Aug 2022 |

| South Africa | Y | Y | Aug 2022 |

| Tanzania | Y | R | Aug 2022 |

| Zambia | Y | R | Aug 2022 |

| Zimbabwe | Y | Y | Aug 2022 |

| Note(s) | (*) Y = Head of State/Gov. Present, R = Country Representative Present. | (*) Y = Head of State/Gov. Present, R = Country Representative Present. | (*) Y = Head of State/Gov. Present, R = Country Representative Present. |

| Issue(s) | Decision(s) |

| SADC Facilitator to the Kingdom of Lesotho | 1. Summit urged the Kingdom of Lesotho to expedite completion of the ongoing reforms. 2. Summit recommended an extension of the mandate of the National Reform Authority for six months until the end of April 2022. |

| SADC Mission in Mozambique (SAMIM) | 1. The Extra-Ordinary Summit of the SADC Troika plus the Chairperson of SADC met virtually to discuss the SADC Mission in Mozambique (SAMIM) on 14 July 2022 and Summit extended the SAMIM mandate with associated budgetary implications and pledged to continue monitoring the situation in Cabo Delgado. 2. Summit approved an interim extension of the SAMIM mandate to facilitate continuation of operations. 3. The SAMIM has begun implementing the Peace Building Support initiatives in Cabo Delgado Province, Mozambique. The programme is funded by the European Union under the Early Response Mechanism of the African Union Commission. The Government of Mozambique is implementing its Cabo Delgado Recovery Plan (PRCD) focusing on humanitarian assistance, infrastructure recovery, and economic and financial recovery. The Government still requires an additional USD 200.0 million of the estimated budget of USD 300.0 million for the PRCD. |

| SADC Integration | 1. Summit reaffirmed SADC’s commitment to establish the SADC Central Bank with the long-term objective deepening integration. 2. Summit approved the transformation of the SADC Parliamentary Forum into a SADC Parliament as a consultative and a deliberative body. 3. Summit approved the Protocol on Statistics and an Agreement Amending the SADC Protocol on Energy. 4. Summit reiterated its call for the removal of sanctions imposed on Zimbabwe. 5. Summit approved the appointment of Mr Elias Mpedi Magosi as the new Executive Secretary of SADC. |

| Miscellaneous | 1. Summit objected to the unilateral decision taken by the African Union Commission to grant the State of Israel Observer Status to the African Union. |

Post-Pandemic Recovery and Global Uncertainty

The economic recovery in SADC has been profoundly affected by the developments in geopolitics, which have affected prices for key commodities, grains, food and fuel. These developments have had unequal impact on the region. The Russia-Ukraine conflict and its impact on Ukrainian grain exports and the subsequent increased sanctions against Russia has reduced global supply and raised prices for a number of commodities. In 2021 Russia accounted for as much as 40% of global exports in iron, crude oil (24.1%), wood, (24.0%), fertilizer (23.7%), nickel (22.5%), wheat (18.6%), coal (15.9%), barley (12.3%) and vegetable oil (11.0%). Meanwhile, Ukraine contributed almost a fifth of global exports in iron (19.3%), vegetable oil (11.3%), maize (11.0%) and barley (10.6%). This has had a significant positive impact on many SADC countries who rely on commodity exports and has allowed some to extend their economic recovery beyond 2021.

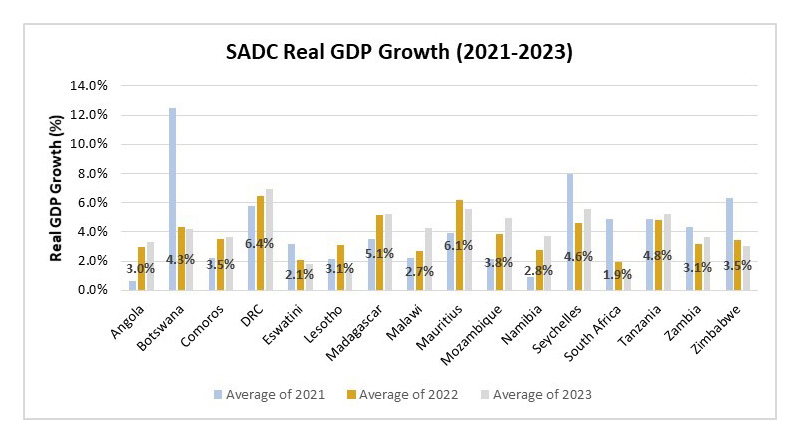

However, the improved export earnings have been offset by the higher price for all crucial imports related to the higher commodity prices, especially fuel, grains, edible oils and other food products. This has been the first round of inflationary impacts linked to the Russia-Ukraine conflict. Given the importance of these countries for iron and fertilizer exports SADC agricultural and industrial production may be severely affects by higher producer price inflation the longer the Russia-Ukraine conflict persists. The net impact has been positive for some countries but all countries have faced increasing inflation. At a regional level, SADC countries are expected to face a slight economic downturn with an average regional growth rate of 3.8% in 2022 (2021: 4.2%) before rebounding to 4.0% in 2023.

The SADC region promotes macroeconomic convergence to strengthen the regional resilience and deepen regional integration throughout Southern Africa. To institutionalise macroeconomic convergence performance, monitoring and evaluation, SADC member states signed the Memorandum of Understanding on Macroeconomic Convergence in 2002 which was subsequently annexed into the Protocol on Finance and Investment in 2006. Member states agreed to an inflation target with a ceiling of 5% in 2012. The recent surge in fuel and food prices linked to the Russia-Ukraine conflict has affected all countries. However, some of the countries that have benefited from a windfall in commodity export earnings have been able to offset some of the imported inflation with appreciation of their domestic currency. Only the Comoros, Eswatini, and Tanzania are expected to meet the SADC macroeconomic convergence target of 5% in 2022. At a regional level, SADC inflation is well above the target at a projected average regional inflation rate of 13.4% in 2022 (2021: 13.6%) before moderating to 8.4% in 2023.

In 2023, only the Seychelles will join the Comoros and the Southern African Customs Union (SACU) countries in meeting the SADC inflation target. Since the Comoros is a member of the CFA Franc Zone it has a fixed exchange rate to the Euro which is guaranteed by the French National Treasury; and Eswatini, Lesotho and Namibia are members of the Common Monetary Area which have their currency pegged to the South African Rand. This inflationary period will definitely test a lot of SADC countries in terms of their ability to remain resilient in the context of global uncertainty. The period will also allow the SACU and CFA Franc zones to demonstrates the resilience that regional integration and macroeconomic convergence provides countries. SADC governments will also be challenged to find innovative ways to support household livelihoods in order to avoid social instability and public protests in the coming inflationary period. This is especially true considering the causes for the current inflation, which are the disruption in global supply chains and the Russia-Ukraine conflict, that cannot be resolved through monetary policy alone.

As part of the macroeconomic convergence agenda, SADC member states also agreed on a budget deficit target to mitigate the impact of long-term sustained deficits. Large budget deficits can be detrimental to an economy if they are sustained over long periods. This can be worsened by slow growth resulting in a rising public debt burden. SADC member states agreed to a budget deficit target with a ceiling of -5% of GDP by 2008 and decreasing that to -3% of GDP in 2012. But this commitment was disrupted by the 2008 global financial crisis and the region has struggled to meet its deficit targets. The COVID-19 pandemic has also worsened matters and forced most SADC countries to borrow from the IMF and seek debt relief through the G20 Debt Service Suspension Initiative (DSSI). In 2022 most SADC governments have had to extend social spending to support household livelihoods and government subsidies to mitigate rising food and fuel prices. Only Angola, Mozambique and Zimbabwe are expected to meet the SADC macroeconomic convergence target of a budget deficit no greater than -3% of GDP in 2022. Countries like Zambia, Namibia, Malawi and Lesotho are at the worst end of the budget deficit scale. Namibia, Malawi and Lesotho are likely to follow Zambia in requesting debt relief from creditors through the G20 Common Framework for Debt Treatment Beyond the DSSI (Common Framework). At a regional level, SADC budget deficits are slightly above the target at a projected average budget deficit of -5.0% of GDP in 2022 (2021: -4.8% of GDP) before moderating to -3.7% of GDP in 2023.

Meanwhile, in 2023, only Botswana will join Angola in meeting the SADC budget deficit target. Angola is expected to continue benefitting from the windfall export earnings due to the high oil prices even though this will be a lesser extent than the windfall earnings in 2022. Botswana is projected to improve its fiscal position due to the windfall export earnings due to the higher commodity prices, particularly diamonds. Diamond prices should remain high in the medium-term given the sanctions against Russia the only country producing more diamonds than Botswana globally.

SADC governments will have to find a balance between the need for increased social spending and innovative growth-enable public investment in order to offset the rising fiscal financing gap. The current fiscal environment requires proactive fiscal management and a collaborative approach to macroeconomic management to balance the divergent demands. The recent pandemic has proven than tax policy is not the only way to finance public spending. However, the current inflationary conditions and speculations about a global recession highlight the very real risk of excessive monetary financing. This problem can only be resolved by implementing an effective industrial policy and public debt management to reduce inflation.

SADC member states have also agreed on a public debt target to mitigate risks associated with long-term sustained public debt levels. Public debt is not in and of itself a weakness but it is the relative size of public as a share of GDP that matters – and public debt servicing costs as a share of government revenue. It is generally accepted that governments do not clear their debts but they grow out of them instead which means that a prudent public debt management strategy aims to primarily utilise public debt to enhance economic growth. Simply put – the higher the relative size of public debt as a share of GDP, the higher the risk of public debt distress. Therefore, SADC member states agreed to a public debt target with a ceiling of 60% of GDP. This target has been historically met by a majority of SADC member states but the COVID-19 pandemic has resulted in elevated public debt for most SADC countries.

In 2022 most SADC governments will have to borrow to meet their social spending needs which should continue raising public debt levels. Eight of the 16 SADC member states are expected to meet the SADC macroeconomic convergence target of public debt levels no greater than 60% of GDP in 2022. Countries like Zambia, Mozambique and Mauritius have elevated public debt levels. However, the elevated public debt levels are not a major in the case of Mauritius given its attractiveness to foreign investors and the relatively low levels of debt servicing costs which constituted less than 10% of government revenue.

At a regional level, SADC public debt is slightly above the target at a projected average public debt of 62.6% of GDP in 2022 (2021: 62.9% of GDP) before moderating to 61.8% of GDP in 2023. The profile for SADC public debt is expected to remain largely unchanged in 2023. The prospects for public debt sustainability will also depend on the performance of the external sector for most SADC countries given the dependence on foreign denominated public debt. Poor performance in the external sector could lead to currency depreciation and higher risk of public debt distress.

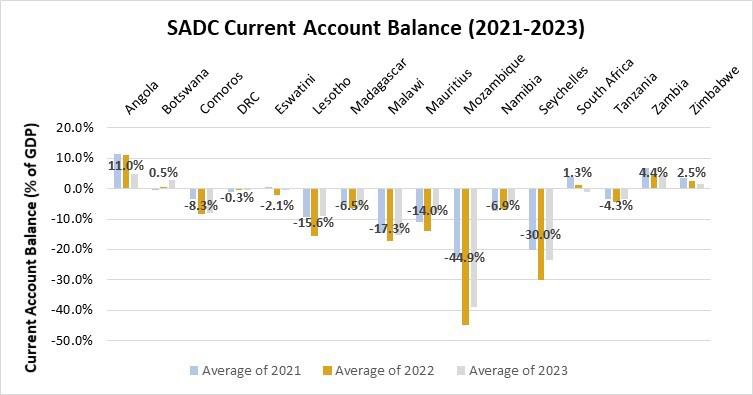

By maintaining a strong external sector position, countries can absorb external shocks like the fluctuations in commodity prices that may reduce export earnings and the balance of payments. This can be done by maintaining a stable and large current account surplus to accumulate foreign exchange reserves. Alternatively, countries have to maintain a stable and sufficient capital and financial account surplus to finance the current account deficit which is not a desirable position. In 2022 current account deficit are projected to widen significantly due to the higher price of crucial fuel and food imports. The landlocked and island SADC member states are expected to be the most severely affected with the Seychelles, Malawi and Lesotho expected to register current account deficits greater than -10% of GDP. Meanwhile, the raw mineral commodity exporters like Angola, Zambia, Zimbabwe and Botswana are expected to register current surpluses due to the windfall in export earnings caused by the surge in commodity prices.

The SADC region started 2022 in a stable economic position. The current rebound in commodity prices has allowed the raw mineral exporters to extend their economic recovery. However, the positive gains due to the surge in commodity prices has been offset by the higher price of crucial food and fuel imports which are affected by the Russia-Ukraine conflict. A number of landlocked and island SADC member states are expected to be more severely affected by the high food and fuel prices. The impact of these divergent economic forces has been positive for some countries. The region has missed most of the macroeconomic convergence targets but there are some where performance has been better. In terms of inflation and budget deficits the region has performed poorly except for a few country exceptions. In terms of public debt, the SADC region is performing relatively well with half of the member states maintaining public debt levels within the target.