Figure 1: Merchandise Trade Balance in eSwatini (2015-2018)

Source: UNCTAD 2019, UNCTADStat Database.

Total merchandise imports to eSwatini have increased to USD 1.8 billion in 2018, from an annual average of USD 1.5 billion from 2015 to 2017[1]. Exports have remained largely unchanged at USD 1.7 billion in 2018 which is equal to the annual average exports from 2015 to 2017[2]. The faster growth in imports has deteriorated eSwatini’s merchandise trade balance to a deficit of -USD 75.3 million in 2018 from a trade surplus averaging USD 190.6 million from 2015 to 2017[3]. The faster growth in imports has not led to a significant deterioration in gross official reserves in spite of the appreciation of the SZL.

Figure 2: Gross Official Reserves in eSwatini (2016-2022)

Sources: IMF 2019, WEO April 2019; IMF 2017, eSwatini 2017 Article IV Report. Note: (*) Figures from 2018 onwards are projections from the IMF, 2019.

Gross official foreign exchange reserves increased to USD 572.0 million in 2018 from an annual average of USD 535.3 million from 2015 to 2017[4]. During this period, the SZL appreciated by 0.7% in 2018 to SZL 13.2 per USD (2017: 10.4%)[5]. The appreciation in the currency has driven the growth in imports following the significant depreciation in 2015 and 2016. The SZL depreciated by an annual average of -14.3% in 2015 and 2016 from SZL 10.8 per USD in 2014 to SZL 14.7 per USD in 2016[6]. Gross official reserves are projected to increase to USD 758.0 million in 2019, which is equivalent to 4.1 months’ import cover[7]. In the forward-looking medium-term from 2020 to 2022, gross official reserves are projected to increase to an annual average of USD 915.7 million (approx. 4.6 months’ import cover)[8]. The faster growth in imports has led to a slight deterioration of the persistent current account surplus.

eSwatini’s current account balance deteriorated to a surplus of USD 462.0 million in 2018, from a surplus averaging USD 608.7 million from 2015 to 2017[9]. In addition to the growth in merchandise imports, which deteriorated the current account balance, demand for services imports also increased as the immediate response to the appreciation of the SZL. Services imports increased to SZL 5.9 billion in 2017 from SZL 4.0 billion in 2015[10]. The current account balance is projected to remain largely unchanged at a surplus of USD 465.0 million (approx. 10.0% of GDP) in 2019[11]. In the forward-looking medium-term from 2020 to 2024, the current account balance is projected to recover to its medium-term average with a surplus averaging USD 608.2 million (approx. 11.6% of GDP)[12].

Figure 3: Current Account Balance in eSwatini (2016-2024)

Sources: IMF 2019, WEO April 2019; IMF 2017, eSwatini 2017 Article IV Report. Note: (*) Figures from 2018 onwards are projections from the IMF, 2019.

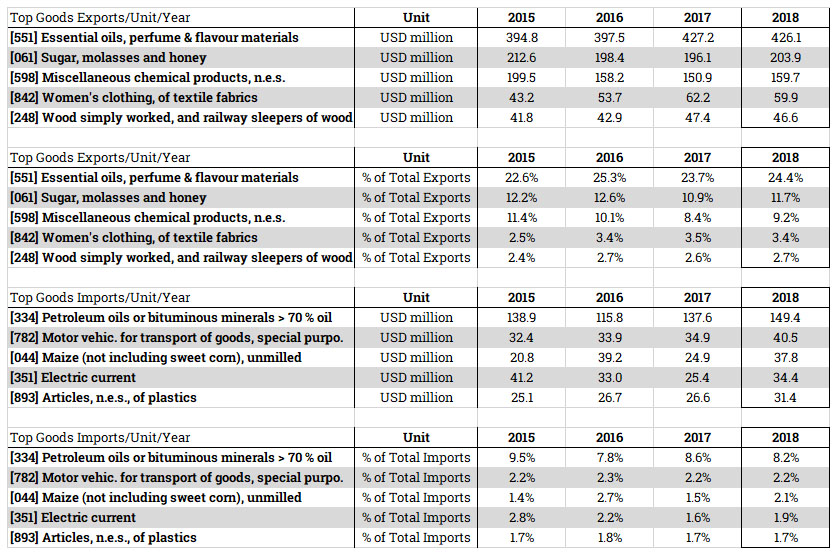

However, eSwatini is still heavily dependent on agricultural exports, particularly essential oils and sugarcane products, which have made exports earnings volatile due to exports being vulnerable to the adverse impact of climate change. For example, the 2015/16 agricultural season in Southern Africa was the driest in 35 years and drought emergencies were declared in eSwatini[13]. As at July 2015, more than half the eSwatini population was left food insecure due to the El Niño drought which led to a two-thirds reduction in maize production and water scarcity[14]. There are also predictions of a repeat of the 2015/16 El Niño drought in 2018/19 and the Food and Agriculture Organisation has been preparing countries to deal with the massive impact on food security and livelihoods[15]. Essential oils and sugarcane products constituted 47.5% of eSwatini’s total export earnings in 2018 which has increased from the average of 47.3% from 2015 to 2017 (2014: 42.1% of exports)[16]. In spite of this concentration of exports, exports of manufactured products like clothing and textiles, chemicals and pharmaceuticals have been growing and assist in maintaining eSwatini’s external sector. In addition, eSwatini is highly integrated in terms of regional trade with neighbouring countries in COMESA and the SADC but its trade is unbalanced.

The top export from eSwatini to COMESA is essential oils, which constituted 5.5% of total exports in 2018 (2015-‘17: 5.4% of total exports)[17]. The value of essential oils exports from eSwatini to COMESA increased to USD 95.5 million in 2018 from an annual average of USD 91.6 million from 2015 to 2017[18]. The other top-four exports from eSwatini to COMESA are chemicals (2.5%), sugarcane products (1.3%) and pharmaceuticals (0.7%) which contributed an additional 4.1% of total exports from eSwatini in 2018. Therefore, the top-five exports constituted 9.6% of total exports from eSwatini in 2018 (2015-‘17: 9.3% of total exports)[19]. The value of the top-five exports from eSwatini to COMESA increased to USD 167.8 million in 2018 from an average of USD 157.6 million from 2015 to 2017[20].

The value of total exports from eSwatini to COMESA increased to USD 210.4 million (approx. 12.1% of total exports) in 2018 from an average of USD 200.5 million (approx. 11.7% of total exports) from 2015 to 2017[21]. These are relatively good or above-average levels of intra-regional trade given that the COMESA average intra-regional exports level was 11.9% of total exports in 2018. The COMESA intra-regional exports, meaning total exports amongst COMESA countries, as a share of total exports to the world increased from an average of 10.5% from 2015 to 2017[22]. Given the overall merchandise trade balance between eSwatini and COMESA, it is clear that that country is taking advantage of indefinite derogation as a member of COMESA. The indefinite derogation means that eSwatini is not obliged to reciprocate preferential import tariffs on imports from other member states under the COMESA Treaty, but still enjoys preferential tariffs and market access for its exports to COMESA[23].

Figure 4: Nominal Exchange Rate in eSwatini (2015-2018)

Sources: CBE 2019a, Annual Economic Review Report 2017/18; CBE 2019b, Recent Economic Developments Nov/Dec 2018; IMF 2017, eSwatini 2017 Article IV Report.

eSwatini’s top-five imports from COMESA are textile yarn, vegetables, cotton, sugar and copper. Although these imports are diversified they constituted only 9.6% of total imports to eSwatini in 2018 (2015-‘17: 2.3% of total imports)[24]. The value of the top-five imports from COMESA to eSwatini increased to USD 14.7 million in 2018 from an annual average of USD 11.1 million from 2015 to 2017[25].

The value of eSwatini’s total imports from COMESA increased to USD 21.5 million (approx. 1.2% of total imports) in 2018 from an annual average of USD 22.3 million (approx. 1.5% of total exports) from 2015 to 2017[26]. These are poor or below-average levels of intra-regional trade given that the COMESA average intra-regional imports level was 6.5% of total imports in 2018[27]. The COMESA intra-regional imports, meaning total imports amongst COMESA countries, as a share of total imports from the world increased only from an average of 5.5% from 2015 to 2017[28].

Table 1: COMESA Regional Trade for eSwatini (2015-2018)

Source: UNCTAD 2019, UNCTADStat Database.

Hence, although eSwatini’s imports from COMESA are diversified, there is significant room to increase imports from COMESA given the significant trade surplus enjoyed by eSwatini in COMESA. The significant merchandise trade surplus with COMESA also reflects the indefinite derogation clause which exclusively benefits eSwatini as a smaller partner country. eSwatini might need to provide more market access to COMESA imports by introducing selective preferential tariffs to improve competitiveness of its domestic industries because the indefinite derogation is not sustainable in the long-term. Therefore, in addition to room to increase and diversify eSwatini’s imports from COMESA, this would help to rebalance its trade in the region. This would make eSwatini’s intra-regional trade balance in COMESA more equitable.

Table 2: SADC Regional Trade for eSwatini (2015-2018)

Source: UNCTAD 2019, UNCTADStat Database.

The top export from eSwatini to SADC is essential oil products, which constituted 24.4% of total exports in 2018 (2015-‘17: 23.9% of total exports)[29]. Essential exports from eSwatini to SADC increased to USD 425.2 million in 2018 from an annual average of USD 406.5 million from 2015 to 2017[30]. The other top-four exports from eSwatini to SADC are sugarcane products (11.7%), chemicals (9.2%), women’s clothing and textiles (3.4%) and wood (2.7%) which contributed an additional 27.0% of total exports from eSwatini in 2018. Therefore, the top-five exports constituted 51.4% of total exports from eSwatini in 2018 (2015-‘17: 51.4% of total exports)[31]. The value of the top-five exports from eSwatini to SADC increased to USD 896.2 million in 2018 from an average of USD 875.5 million from 2015 to 2017[32].

The value of total exports from eSwatini to SADC increased to USD 1.3 billion (approx. 72.1% of total exports) in 2018 from an average of USD 1.2 billion (approx. 73.2% of total exports) from 2015 to 2017[33]. These are very high levels of intra-regional trade given that the SADC average intra-regional exports level was 17.9% of total exports in 2018. The SADC intra-regional exports, meaning total exports amongst SADC countries, as a share of total exports to the world decreased from an average of 20.8% from 2015 to 2017[34]. Hence, eSwatini is highly integrated in SADC and relies on the region for most of its exports. There is little room to increase its exports to SADC countries.

eSwatini’s top-five imports from SADC are petroleum, motor vehicles, maize, electrical current and plastics. Although these imports are diversified they constituted 16.1% of total imports to eSwatini in 2018 (2015-‘17: 16.7% of total imports)[35]. The value of the top-five imports from SADC to eSwatini increased to USD 293.6 million in 2018 from an annual average of USD 252.1 million from 2015 to 2017[36].

The value of eSwatini’s total imports from SADC increased to USD 1.5 billion (approx. 81.9% of total imports) in 2018 from an annual average of USD 1.2 billion (approx. 81.8% of total exports) from 2015 to 2017[37]. These are very high levels of intra-regional trade given that the SADC average intra-regional imports level was 20.9% of total imports in 2018[38]. The SADC intra-regional imports, meaning total imports amongst SADC countries, as a share of total imports from the world increased only from an average of 20.7% from 2015 to 2017[39]. This illustrates the reliance of eSwatini on SADC for its imports, which is more significant than its reliance on SADC for its exports and at levels well above the average intra-regional trade levels.

There is significant room to rebalance by increasing imports from COMESA or reduce eSwatini’s dependence on SADC. eSwatini might want to reassess the balance of benefits to its COMESA and SADC membership given that it is significantly more dependent on SADC with a clear imbalance between the two regional economic communities. Therefore, there is significant room to rebalance the dependence on eSwatini imports between COMESA and SADC, in order to reduce the country’s reliance on SADC and increase the benefits and gains from its COMESA membership. This would also make eSwatini intra-regional trade balance with COMESA and SADC more equitable. However, the overreliance of eSwatini on SADC may reflect structural constraints like geographic proximity which constrains the country’s ability to expand its trade with COMESA.

[1] UNCTAD 2019. UNCTADStat Database, United Nations Conference on Trade and Development: Geneva. Available At: https://unctadstat.unctad.org/ [Last Accessed: 26 September 2019].

[2] UNCTAD 2019. UNCTADStat Database, ibid.

[3] UNCTAD 2019. UNCTADStat Database, ibid.

[4] IMF 2019. WEO April 2019; International Monetary Fund: Washington, D. C. Available At: https://www.imf.org/ [Last Accessed: 26 September 2019]; IMF 2017. eSwatini 2017 Article IV Report, International Monetary Fund: Washington, D. C. Available At: https://www.imf.org/ [Last Accessed: 26 September 2019].

[5] IMF 2017. eSwatini 2017 Article IV Report, ibid.; CBE 2019a. Annual Economic Review Report 2017/18; Central Bank of eSwatini: Manzini. Available At: https://www.centralbank.org.sz/ [Last Accessed: 26 September 2019]; CBE 2019b. Recent Economic Developments Nov/Dec 2018; Central Bank of eSwatini: Manzini. Available At: https://www.centralbank.org.sz/ [Last Accessed: 26 September 2019].

[6] IMF 2017. eSwatini 2017 Article IV Report, ibid.; CBE 2019a. Annual Economic Review Report 2017/18; ibid.; CBE 2019b. Recent Economic Developments Nov/Dec 2018; ibid.

[7] IMF 2019. WEO April 2019; ibid.

[8] IMF 2019. WEO April 2019; ibid.

[9] IMF 2019. WEO April 2019; ibid.; IMF 2017. eSwatini 2017 Article IV Report, ibid.

[10] IMF 2019. WEO April 2019; ibid.; IMF 2017. eSwatini 2017 Article IV Report, ibid.

[11] IMF 2019. WEO April 2019; ibid.

[12] IMF 2019. WEO April 2019; ibid.

[13] FAO 2016. Southern Africa: Situation Report – October 2016, Food and Agriculture Organisation: Harare. Available At: http://www.fao.org/ [Last Accessed: 7 October 2019].

[14] FAO 2016. Southern Africa: Situation Report – October 2016, ibid.

[15] FAO 2018. FAO in Southern Africa Prepares for the Looming 2018/19 El Niño Occurrence, on the Food and Agriculture Organisation Website, viewed on 7 October 2019, from http://www.fao.org/.

[16] UNCTAD 2019. UNCTADStat Database, ibid.

[17] UNCTAD 2019. UNCTADStat Database, ibid.

[18] UNCTAD 2019. UNCTADStat Database, ibid.

[19] UNCTAD 2019. UNCTADStat Database, ibid.

[20] UNCTAD 2019. UNCTADStat Database, ibid.

[21] UNCTAD 2019. UNCTADStat Database, ibid.

[22] UNCTAD 2019. UNCTADStat Database, ibid.

[23] SRA 2019. Free Trade and Preferential Agreements, on eSwatini Revenue Authority Website, viewed on 30 September 2019, from http://www.sra.org.sz/.

[24] UNCTAD 2019. UNCTADStat Database, ibid.

[25] UNCTAD 2019. UNCTADStat Database, ibid.

[26] UNCTAD 2019. UNCTADStat Database, ibid.

[27] UNCTAD 2019. UNCTADStat Database, ibid.

[28] UNCTAD 2019. UNCTADStat Database, ibid.

[29] UNCTAD 2019. UNCTADStat Database, ibid.

[30] UNCTAD 2019. UNCTADStat Database, ibid.

[31] UNCTAD 2019. UNCTADStat Database, ibid.

[32] UNCTAD 2019. UNCTADStat Database, ibid.

[33] UNCTAD 2019. UNCTADStat Database, ibid.

[34] UNCTAD 2019. UNCTADStat Database, ibid.

[35] UNCTAD 2019. UNCTADStat Database, ibid.

[36] UNCTAD 2019. UNCTADStat Database, ibid.

[37] UNCTAD 2019. UNCTADStat Database, ibid.

[38] UNCTAD 2019. UNCTADStat Database, ibid.

[39] UNCTAD 2019. UNCTADStat Database, ibid.